Unveiling the Return on Investment in 409A Valuation

Understanding the return on investment (ROI) in 409a valuation cost is crucial for businesses seeking not just compliance but also strategic financial benefits.

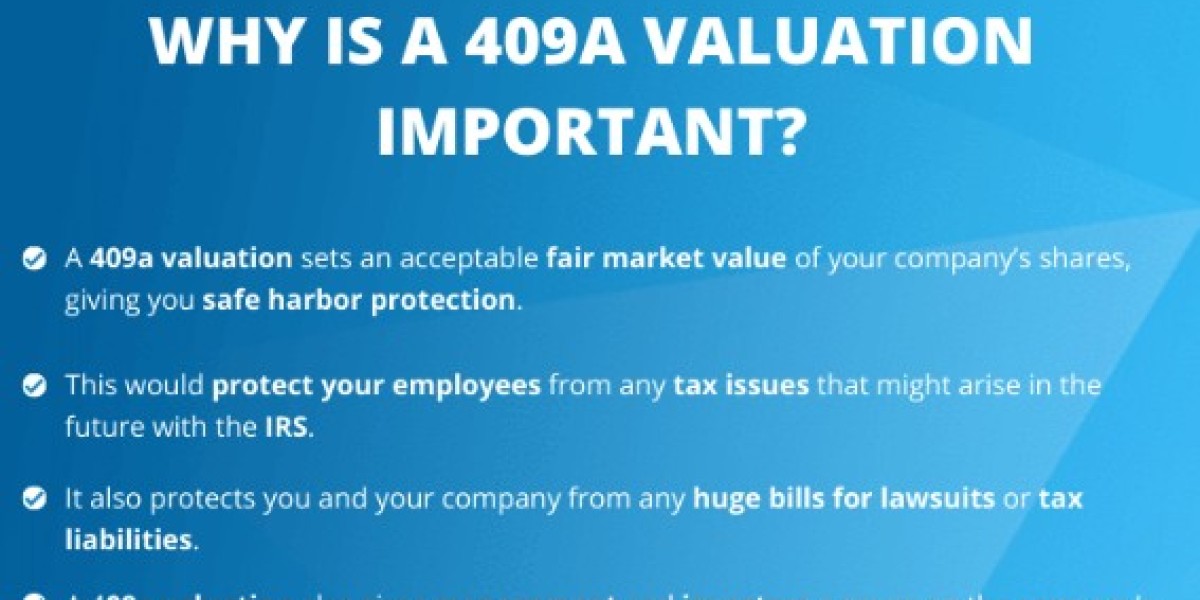

The Strategic Value of 409A Valuation

This section explores how 409A valuation goes beyond compliance, providing businesses with strategic insights that can contribute to long-term financial success.

Identifying Tangible and Intangible Benefits

Delve into the various tangible and intangible benefits that businesses can derive from a well-executed 409A valuation. From informed decision-making to enhanced investor confidence, discover the multifaceted advantages.

Strategic Decision-making for Cost Optimization

Tailoring Valuation Frequency

Choosing the right frequency for 409A valuation can impact costs. This subsection discusses how businesses can tailor the valuation frequency based on their specific needs, optimizing costs without compromising accuracy.

Selective Application of Premiums and Discounts

A nuanced approach to applying premiums and discounts is crucial. Learn how businesses can strategically leverage these factors to optimize valuation costs while adhering to regulatory requirements.

Leveraging Technology for Cost-Efficient Valuations

Advanced Valuation Tools and Software

Explore the realm of advanced valuation tools and software. This part of the article highlights how embracing technology can streamline the valuation process, reduce errors, and ultimately lead to cost savings.

Data Analytics for Precision

Harnessing the power of data analytics can significantly impact the accuracy of 409A valuation. Understand how businesses can leverage data analytics to enhance precision, ensuring a more cost-effective valuation process.

Collaborative Strategies for Cost Optimization

Engaging Internal Stakeholders

Internal collaboration is often an untapped resource. Discover how involving internal stakeholders in the valuation process can not only optimize costs but also contribute to a more comprehensive understanding of the business value.

Negotiating Fees with Valuation Experts

Effective negotiation with valuation experts is an art. This section provides insights into how businesses can negotiate fees, ensuring a fair and cost-effective partnership with professionals in the field.

Conclusion

In conclusion, the journey of maximizing ROI in 409A valuation involves strategic decision-making, leveraging technology, and fostering collaborative approaches. By viewing the valuation process not just as a compliance requirement but as an opportunity to enhance business insights and financial strategies, businesses can extract maximum value while optimizing costs. The key lies in adopting a holistic approach that aligns 409A valuation with broader business objectives, ensuring a smart and cost-effective investment in financial transparency and strategic decision support.