Key Market Insights

Eminent representatives from companies across the world attest to the fact that there is growing interest in the digital therapeutics market, highlighting the prevalent and anticipated trends in RD and adoption

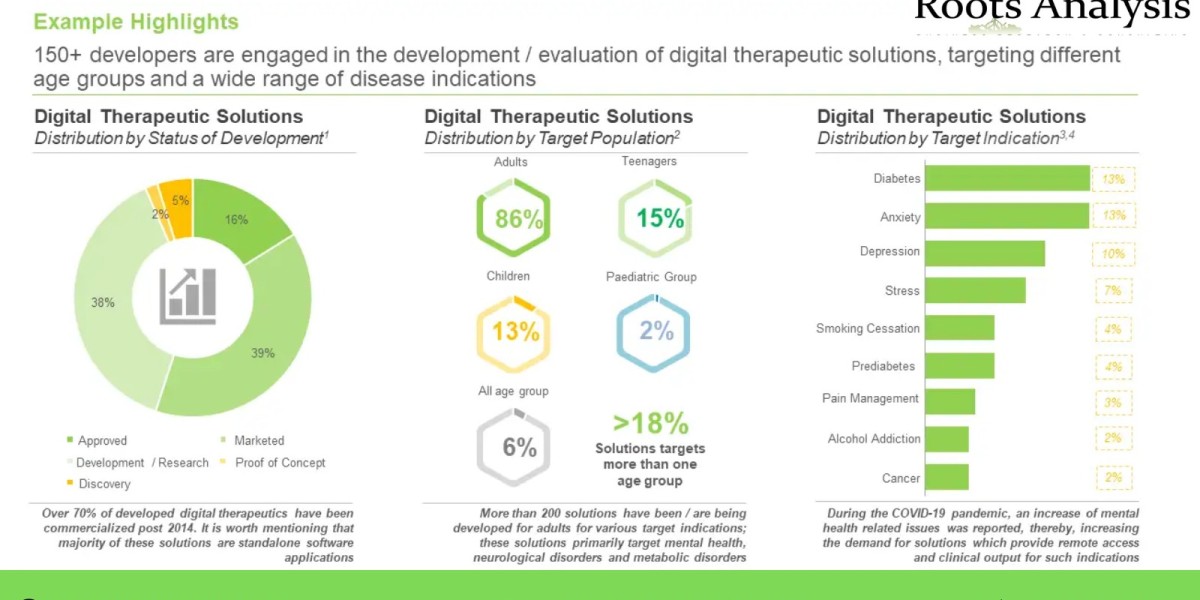

More than 150 industry players are engaged in evaluating the potential of several prescription (validated through clinical research) digital therapeutic solutions to prevent / treat various chronic diseases

The pipeline features a variety of digital health applications and therapy solutions that are in different stages of development, being investigated for diverse purposes, across a wide-range of clinical conditions

These solutions have demonstrated applicability across more than 15 therapeutic areas; several products have been marketed / approved for the treatment or prevention of medical conditions such as mental health problems neurological disorders, metabolic disorders and cardiovascular disorders.

In pursuit of a competitive edge, digital therapeutic solution developers are focusing on the integration of advanced features, such as artificial intelligence (AI), virtual reality (VR), gaming solutions and others into their respective products and affiliated offerings

In the last few years, more than 500 clinical trials evaluating the potential benefits of digital therapeutics in more than 1.6 million patients, have been registered; most of these were / are being conducted at various centers in the US

Apart from the clinical benefit, cost is another key determinant of the acceptance and adoption of such novel interventions; pricing strategy matrix is likely to assist players to evaluate competitive market prices for solutions

To support the ongoing innovation in this field, several private and public investors have made substantial capital investments, amounting to approximately USD 8.4 billion, in various initiatives of stakeholders

The growing interest in this field is reflected by the increase in partnership activity, involving both international and indigenous stakeholders, across different geographical marketplaces

In order to promote the adoption of proprietary digital health solutions, developers are actively exploring various marketing strategies in order to highlight key features of their products across a number of platforms

Given the rising demand for remote and digital solution and a growing pipeline of modern medicines to treat various disease conditions, the market for evidence-based digital therapeutics is poised to grow at a CAGR of ~20% till 2035

The projected market opportunity is anticipated to be well-distributed across different therapeutic areas, distribution channels and key geographical regions

Table of Contents

1. PREFACE

1.1. Introduction

1.2. Key Market Insights

1.3. Scope of the Report

1.4. Research Methodology

1.5. Frequently Asked Questions

1.6. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

3.1 Chapter Overview

3.2. Digitization in the Healthcare Sector

3.3. Next-Generation Healthcare Solutions

3.4. Key Concepts Associated with Digital Health Solutions

3.5. Overview of Digital Therapeutics

3.6 Concluding Remarks

4. CURRENT MARKET LANDSCAPE

4.1. Chapter Overview

4.2. Digital Therapeutics: Overall Market Landscape

4.3. Digital Therapeutics: Additional Information

4.4. Digital Therapeutics: List of Developers

4.5. Leading Developers: Analysis by Number of Digital Therapeutic Solutions

4.6. Leading Developers: Analysis by Portfolio Strength, Target Indication, and Company Size (4D Bubble Representation)

4.7. Analysis by Therapeutic Area and Company Size (Tree Map Representation)

4.8. Analysis of Regional Activity (World Map Representation)

5. PRODUCT COMPETITIVENESS ANALYSIS

5.1. Chapter Overview

5.2. Assumptions / Key Parameter

5.3. Methodology

5.4. Key Therapeutic Areas

6. COMPANY PROFILES

6.1. Chapter Overview

6.2. Akili Interactive

6.2.1 Company Overview

6.2.2. Product Portfolio

6.2.3. Recent Developments and Future Outlook

6.3. Big Health

6.4. dreem

6.5 Kaia Health

6.6. MindMaze

6.7. Omada Health

6.8. Pear Therapeutics

6.9. Vida Health

6.10. Voluntis

6.11. WellDoc

6.12. Wellthy Therapeutics

7. CLINICAL TRIAL ANALYSIS

7.1. Chapter Overview

7.2. Scope and Methodology

7.3. Digital Therapeutics: Clinical Trial Analysis

7.4. Clinical End-Points Analysis

8. FUNDING AND INVESTMENT ANALYSIS

8.1. Chapter Overview

8.2. Type of Funding Models

8.3. Digital therapeutics: List of Funding and Investments

8.4. Concluding Remarks

9. PARTNERSHIPS AND COLLABORATIONS

9.1. Chapter Overview

9.2. Partnership Models

9.3. Digital Therapeutics: List of Partnerships and Collaborations

10. GO-TO-MARKET STRATEGY

10.1. Chapter Overview

10.2. Marketing Strategies Adopted by Digital Therapeutic Developers

10.3. Concluding Remarks

11. BOWMAN CLOCK PRICING STRATEGY ANALYSIS

11.1. Chapter Overview

11.2. Bowman Strategy Clock

11.3 Roots Analysis Framework

11.4. Concluding Remarks

12. MARKET FORECAST

12.1. Chapter Overview

12.2. Forecast Methodology and Key Assumptions

12.3. Global Digital Therapeutics Market, 2022-2035

12.4. Digital Therapeutics Market: Analysis by Type of Solution, 2022-2035

12.5. Digital Therapeutics Market: Analysis by Purpose of Solution, 2022-2035

12.6. Digital Therapeutics Market: Analysis by Type of Therapy, 2022-2035

12.7. Digital Therapeutics Market: Analysis by Business Model, 2022-2035

12.8. Digital Therapeutics Market: Analysis by Therapeutic Area, 2022-2035

12.9. Digital Therapeutics Market: Analysis by Geography, 2022-2035

12.10. Concluding Remarks

13. WOMEN DIGITAL HEALTH: AN EMERGING NEW CONCEPT

13.1. Introduction: Women Digital Health

13.2. Chapter Overview

13.3. Womens Digital Health: Product Pipeline

13.4. Womens Digital Health: Developer's Landscape

14. SWOT ANALYSIS

14.1. Chapter Overview

14.2. Comparison of SWOT Factors

15. EXECUTIVE INSIGHTS

15.1. Chapter Overview

15.2. Ampersand Health

15.3. Canary Health

15.4. Dnurse Technology

15.5. Embr Labs

15.6. Exosystems

15.7. Floreo

15.8. GAIA

15.9. Healios

15.10 JOGGO Health

15.11. metaMe Health

15.12. SelfBack

15.13. Somatix

15.14. Tilak Healthcare

15.15. Turnaround Health

15.16. Vida Health

15.17. Voluntis

15.18. Wellthy Therapeutics

15.19. Undisclosed

16. CONCLUDING REMARKS

17. APPENDIX 1: TABULATED DATA

18. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

To view more details on this report, click on the link