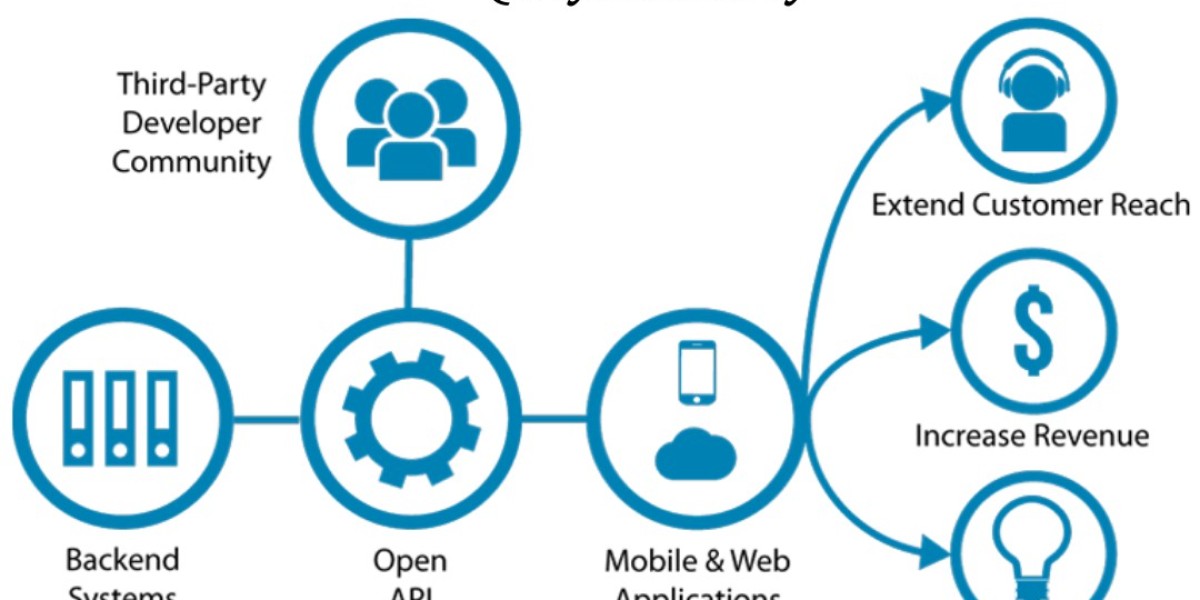

Merchant Open Banking Solutions API platform

Merchant Open Banking Solutions API platform refers to a platform that provides "merchants with access to open banking APIs" (Application Programming Interfaces) to facilitate secure and seamless payments and transactions. Open banking refers to the practice of sharing customer financial data between financial institutions and third-party providers via APIs, which allows for more innovative and efficient financial services.

Merchants can use an "open banking API platform to access banking data" such as transaction history, account balance, and payment initiation. This data can then be used to provide a range of financial services such as accounting software, invoicing, and payment processing. "Open banking API platforms" can also offer value-added services such as fraud detection, risk management, and compliance.

By leveraging "open banking APIs", merchants can streamline their payment processes, reduce costs, and enhance their customer experience. The platform also provides merchants with access to a wider range of financial services, such as lending and investment opportunities. Overall, the "Merchant Open Banking Solutions API platform provides" a more efficient and secure way for merchants to manage their finances and payments.

What is Open Banking Regulation?

Open banking regulation refers to laws and regulations that require banks and financial institutions to open up their data and infrastructure to third-party service providers. These regulations aim to promote competition and innovation in the banking industry, and to give consumers greater control over their financial data.

The concept of "open banking" was first introduced in Europe with the enactment of the "Payment Services Directive 2" (PSD2) in 2015. PSD2 requires banks to allow third-party providers to access customer data, with the customer's consent, and to initiate payments on their behalf.

Similar regulations have been introduced in other parts of the world, including the United Kingdom, Australia, and Canada. In the United States, there is no federal open banking law, but some states, such as California, have passed their own data privacy laws that could pave the way for "open banking".

The "benefits of open banking" include increased competition, lower costs, and greater consumer control over their financial data. However, there are also concerns about data privacy and security, as well as the potential for increased fraud and cyber attacks.

Overall, "open banking regulation" is a rapidly evolving area that will continue to shape the banking industry and the way consumers interact with their financial institutions.

What is Open Banking

Open banking solutions refer to a financial technology (fintech) concept that involves the use of "open application programming interfaces" (APIs) to enable financial institutions to share their customers' financial data with third-party providers. This allows for greater collaboration between banks and fintech companies, leading to the creation of new financial products and services.

Some examples of open banking solutions include:

Account aggregation: This involves consolidating financial information from multiple accounts into a single dashboard, allowing users to view their entire financial picture in one place.

Payment initiation: This allows users to initiate payments directly from their bank accounts without the need for a third-party "payment service provider".

Identity verification: "Open banking solutions" can also be used for identity verification purposes, making it easier for businesses to onboard new customers and comply with Know Your Customer (KYC) regulations.

Lending and credit scoring: Fintech companies can "use open banking" data to offer personalized loan products and determine creditworthiness based on a customer's financial history.

Overall, "open banking solutions offer" a range of benefits for both consumers and businesses, including increased competition, improved financial transparency, and the development of innovative financial products and services.

What is an API in Open Banking?

In Open Banking, an API (Application Programming Interface) is a set of protocols, tools, and standards for building software applications that allow third-party providers to access financial data and services securely. "APIs in Open Banking" facilitate communication between banks and third-party providers, enabling the sharing of financial data and services in a standardized and secure way.

"Open Banking APIs provide developers" with a range of functionalities, such as requesting account information, initiating payments, and verifying customer identities. They also allow third-party providers to access and use customer data with their consent, such as transaction history, account balances, and spending patterns, to provide innovative financial services and products.

APIs are a crucial component of Open Banking, as they enable banks to open up their data and services to third-party providers, creating a more competitive and innovative financial services ecosystem. Additionally, "APIs in Open Banking" are built with security and privacy in mind, ensuring that customer data is protected and only accessed with explicit consent.

How Does Open Banking Work?

Open Banking is a system that enables third-party providers (TPPs) to access financial data and services through application programming interfaces (APIs). This allows users to securely share their financial information with third-party providers, giving them access to a range of financial services that were previously only available through traditional banks.

The "Open Banking system typically" consists of two main components:

APIs: These are software interfaces that allow third-party providers to connect to a bank's data and services. APIs enable secure and standardized data sharing between banks and third-party providers.

Consent framework: This is a set of rules and procedures that govern how users can give their consent to share their financial data with third-party providers. Users have complete control over which data is shared and who it is shared with.

Here's a simplified overview of how Open Banking works:

A user decides to use a third-party provider (TPP) for a financial service, such as budgeting or payments.

The user gives their consent to the TPP to access their financial data from their bank.

The TPP uses APIs to securely access the user's financial data from their bank.

The TPP provides the service requested by the user, such as budgeting insights or making a payment.

"Open Banking has many benefits" for users, including greater control over their financial data, improved access to financial services, and increased competition among financial service providers.

Open banking api|Open banking casinos|Open banking solutions|Opend banking platforms|Open banking api platform|Open banking api providers|Best opened banking solutions|Merchant opened baking solutions|Banking api providers|Open banking api platform|Open bank account online|Opened a business bank account|

Open baking solutions for mastercard|Open banking payment solutions by ecommerces