The standpoint for 2019 is that gas ventures will rule the arranged FIDs fully expecting rising interest for flammable gas.

Last year's restored oil cost saw various oil and gas projects all over the planet arrive at their Last Speculation Choices (FIDs), a vital stage in a's venture and execution, while the viewpoint for 2019 is that gas undertakings will rule the arranged FIDs, fully expecting rising interest for flammable gas.

Last venture choices in oil and gas

The quantity of FIDs taken on upstream oil and gas projects were up for 2018, especially in the last part of the year, after a time of oil cost ascends in the initial 3/4 of 2018.

Oil and gas makers pushed ahead with an extensive variety of improvement types, for example, the Tortue drifting condensed flammable gas (FLNG) project in Mauritania and Senegal, the Ohaji North/Assa South customary gas field in Nigeria, the Aspen weighty oil improvement in Canada and a development to the More prominent Mooses Tooth traditional oil resource in the US.

Other key undertakings with FIDs anticipated 2019 incorporate goliath gas fields in Mozambique and Russia, as well as oil improvements in Mexico, Brazil and Guyana.

Russia and Mozambique have the biggest tasks with booked FIDs in 2019, positioned by recoverable assets. These are principally gas megaprojects expected to supply melted flammable gas (LNG) sends out, situated in Region 1 and Region 4 in the Rovuma Bowl in Mozambique and in the West Siberian Bowl in Russia.

This pattern is reflected in different oil and gas investment regions, especially in the Asia-Pacific locale, with significant gas advancements to take care of LNG projects in Australia and Papua New Guinea, and for power interest in Vietnam.

As the oil value kept on recuperating in 2018, there was a huge increase in the quantity of FIDs endorsed. Cost-cutting and higher money saves from discounted venture throughout the course of recent years has prompted an expansion in FIDs and a more hopeful viewpoint in the business, in spite of the unpredictable oil cost.

The essential test for organizations making and intending to make FIDs has been to get financing.

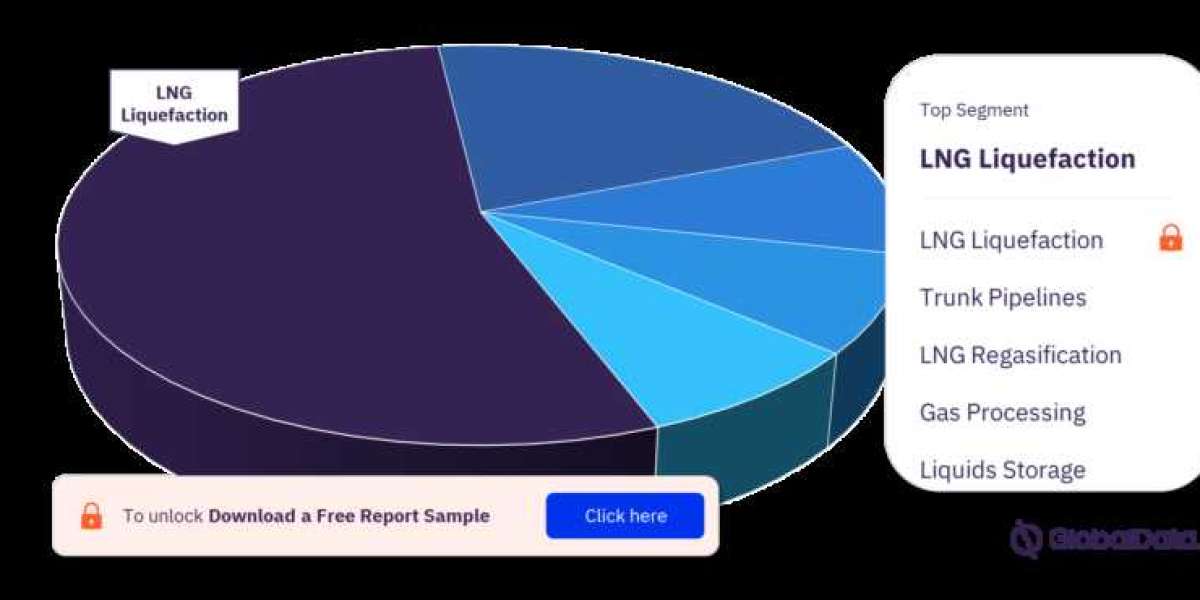

Gas advancements, going from coastal to ultra-deepwater, are supposed to be the essential concentration for speculation, as request is figure to develop fundamentally from nations changing to bring down carbon powers.

Oil improvements make up a more modest extent of arranged FIDs, as organizations focus on a select scope of tasks.

For more oil and gas investment market, download a free report sample