Malaysia is set to survey its unfamiliar proprietorship rule for back up plans. It commanded that unfamiliar guarantors ought to chop down responsibility for nearby units by almost a third and bring Malaysian safety net providers.

The Monetary Times, refering to three sources with direct information regarding this situation, has detailed that the country's national bank is presently open to exchange. Also, it could permit unfamiliar guarantors to keep full proprietorship.

Malaysian safety net providers on the lookout

One source with direct information on the reasoning among national bank authorities was cited by distribution as saying: "My sense is that Bank Negara is returning to its past place of not driving organizations to sell down".

In 2017, the Bank Negara Malaysia requested unfamiliar safety net providers to decrease their stakes in privately consolidated protection firms to conform to its 2009 rule. Besides, this set a 70% limit for unfamiliar responsibility for protection organizations.

Thus, numerous worldwide Malaysia life insurance industry guarantors, for example, Japan's Tokio Marine Property, Hong Kong-based AIA Gathering, Extraordinary Eastern Possessions, Prudential, and Zurich Protection, Chubb and eight other unfamiliar organizations were thinking about to strip 30% of the Malaysian business to neighborhood state-connected assets or rundown the nearby units.

To meet the standard, various global protection bunches were hoping to take on joint endeavor courses. Then again, they might veer off pieces of their business by sending off an Initial public offering.

Prudential was wanting to send off a $700m Initial public offering in Malaysia, as per the distribution.

The most recent move is pointed toward reducing the trepidation among worldwide guarantors who have extended in Malaysia lately. They were drawn in by lower protection entrance, vigorous monetary development and developing working class pay.

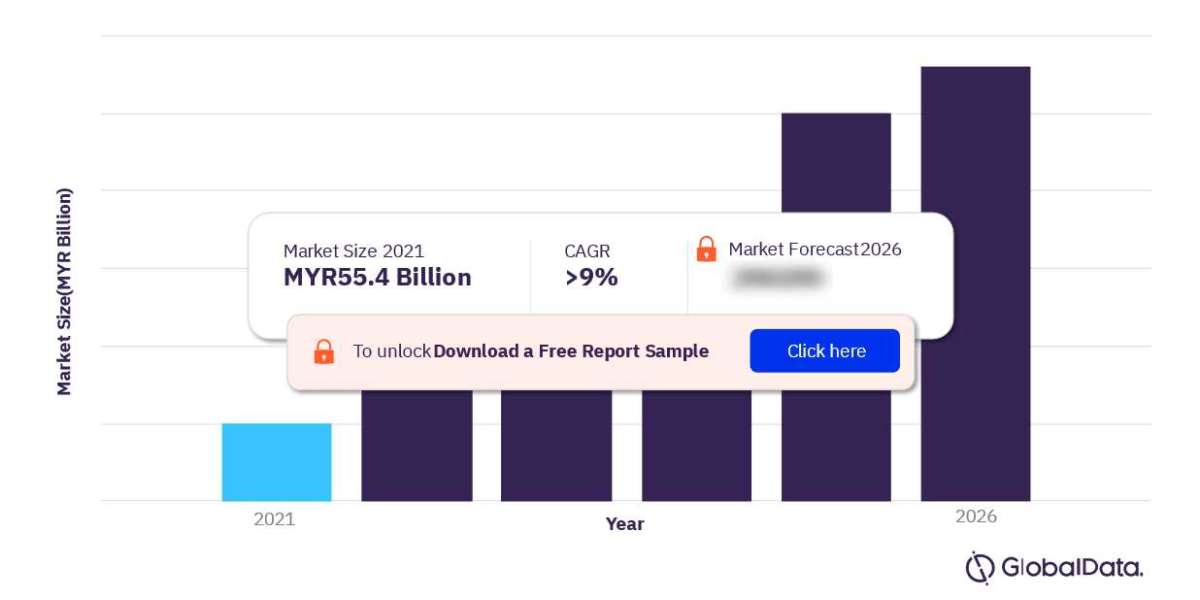

For more Malaysia life insurance market forecast, download a free report sample