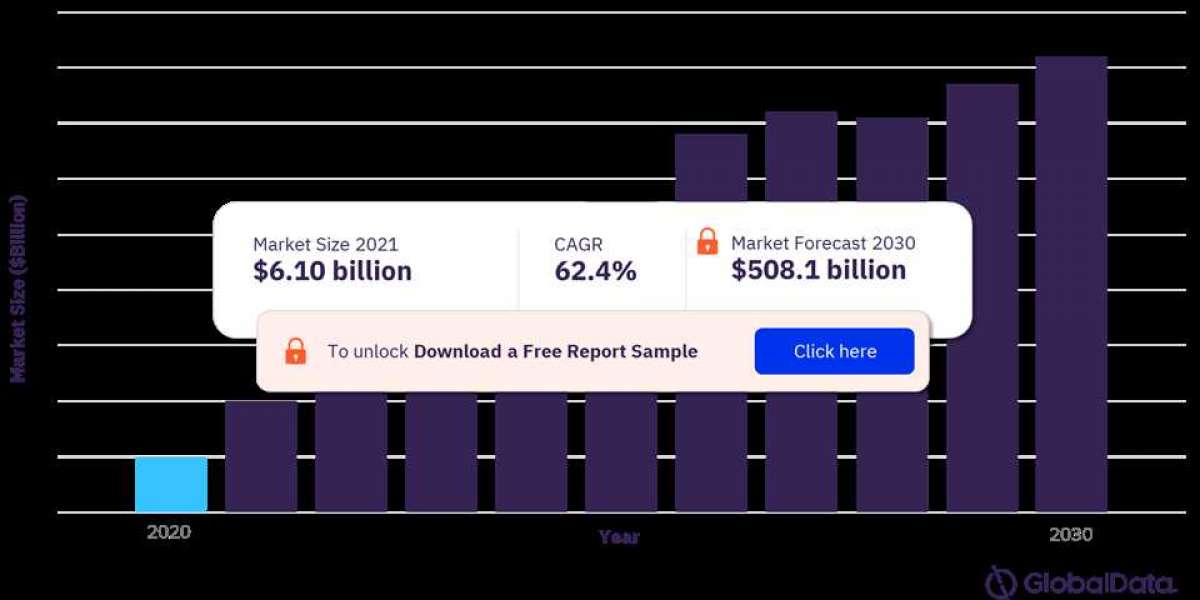

The global blockchain market size was valued at US$6.10 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 62.4% during 2022-2030. Supply chain management and cross-border payments are the most prominent application markets for the blockchain.

The movement of goods across the globe depends on an extraordinarily complex set of processes and a vast array of regulations. Blockchain has a role to play in supporting the digitization of supply chains and increasing transparency and efficiency. Businesses are looking to blockchain to reduce the time and costs of moving products. Integration with other technologies, particularly IoT, will be crucial for getting the most out of blockchain in the supply chain. Throughout the COVID-19 pandemic, the concern for supply chain security from consumers has not lessened. Rather, these concerns have amplified as consumers' product decisions are influenced more by trust and familiarity. With blockchain, companies can trace products through supply chains to flag potentially damaging in-transit events, such as signs of tampering, extreme environmental conditions, or careless handling. If a manufacturer identifies a quality issue with a product, blockchain can help vendors expedite recalls by quickly determining the location of any inventory across the supply chain that needs to be kept out of circulation.

Blockchain is increasingly used to speed up payments, improve transparency, eliminate intermediaries, and reduce costs. Cross-border payments via traditional payment methods are complex, expensive, and slow. The World Bank estimates the average transaction cost for remittances to be around 6.5%, and even payment disruptors like PayPal and TransferWise take days to settle cross-border payments. Aside from facilitating faster and cheaper payments, smart contracts can, for example, be used for consumption-based payments and dispute resolution, facilitating chargebacks.