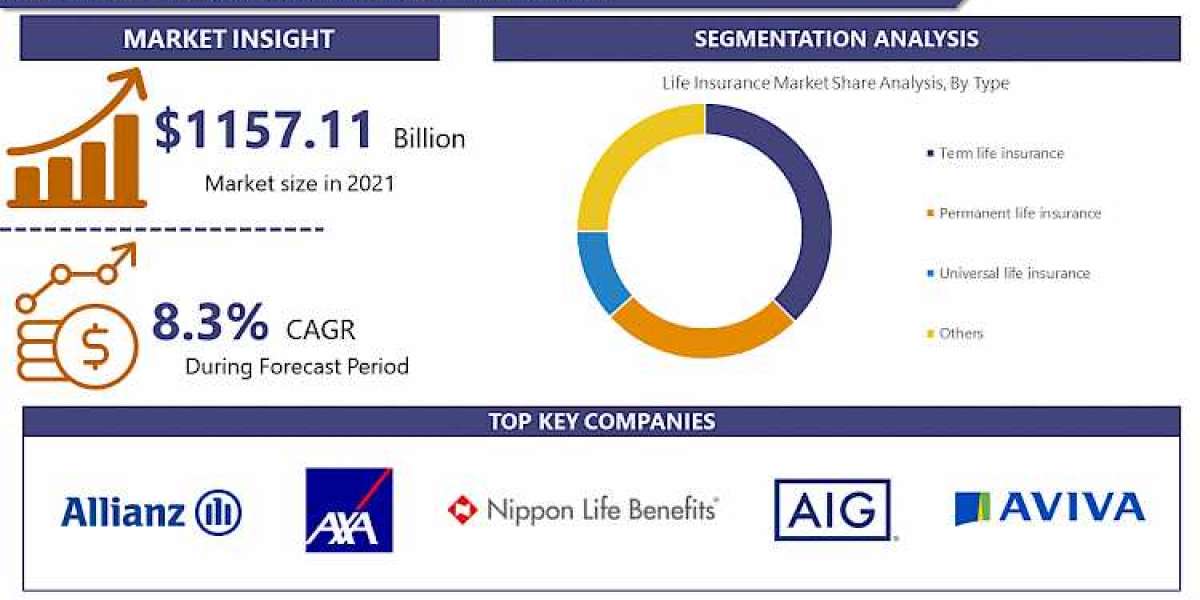

Global Life Insurance market was estimated at USD 1,157.11 billion in 2021, and is anticipated to reach USD 2021.96 billion by 2028, growing at a CAGR of 8.3%.

The latest study released on the Global Life Insurance Market by Introspective Market Research evaluates market size, trend, and forecast to 2028. The Life Insurance market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Life insurance means it is a contract plan between an insurance company and an insurance policyholder, where the insurer gives the guarantee to pay a sum of a fixed amount and it is exchanged for a premium after a set period or after the death of the insured person. Life insurance provides financial protection to the insurer and their family. Life insurance can provide the service to people including newly married couples, business owners, People nearing retirement with fewer savings, and parents with young children. The various brands are involved in providing life insurance services with different policies.

Major Key Players for Life Insurance Market:

- Allianz

- AXA

- Nippon Life Insurance

- American Intl. Group

- Aviva

- Assicurazioni Generali

- State Farm Insurance

- Dai-ichi Mutual Life Insurance

- Munich Re Group

- Zurich Financial Services

- Prudential

- Asahi Mutual Life Insurance

- Sumitomo Life Insurance

Market Dynamics and Factors:

Life insurance is a crucial part of financial planning. It offers several benefits to people such as providing financial security, disciplined investment, tax-free payout, life risk cover, death benefits, return on investment, loan options, life stage planning, and assured income benefits. Apart from this life insurance helps people in critical illness and personal accidents. In the market, multiple numbers of insurance policies are available such as ULIPs, Money-Back, Child Life, and Endowment plan. These policies contain investment components that offer wealth appreciation. Additionally, they provide retirement plans such as annuity plans, saving plans, and endowment plans that help people on retirement. These benefits help to increase the market in the forecast year. Life insurance has an expensive plan and different terms and conditions of insurance plans which involve in hamper the growth of the market of life insurance in the projected year.

Request a free sample copy: - https://introspectivemarketresearch.com/request/15077

Life Insurance Market Report Highlight:

- By type, the permanent life insurance segment is expected to have the maximum market share in life insurance software during the projected period. Permanent life insurance offers the whole life benefits, thus rising the number of policyholders of permanent life insurance which propel the growth of the market.

- By application, the agency segment is expected to have the maximum market share in the life insurance software market during the forecast period. Most of the population buys the insurance policy from the agency which boosts the market of life insurance in the analysis period.

- By region, North America is expected to dominate the life insurance software market, during the projection period. According to Statista, 52% of Americans have owned life insurance in 2021 which propels the growth of the market in the forecast year.

Inquiry Before Purchase: - https://introspectivemarketresearch.com/inquiry/15077

Life Insurance Market Segmentation:

By Type

- Term-life insurance

- Permanent-life insurance

- Others

By Provider

- Private Agencies

- Government Agencies

- Others

Regional Outlook

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Russia, Spain, Rest of Europe)

- Asia-Pacific (China, India, Japan, Southeast Asia, Rest of APAC)

- Middle East Africa (GCC Countries, South Africa, Rest of MEA)

- South America (Brazil, Argentina, Rest of South America)

Purchase the Report: -

https://introspectivemarketresearch.com/checkout/?user=1_sid=15077

Read More Report:

https://introspectivemarketresearch.com/reports/cyber-liability-insurance-market/

https://introspectivemarketresearch.com/reports/temporary-car-insurance-market/

https://introspectivemarketresearch.com/reports/new-drivers-car-insurance-market/

About us:

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assisting our clients to grow and have a successful impact on the market. Our team at IMR is ready to assist our clients to flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, that specializes in using big data and advanced analytics to show the bigger picture of the market trends. We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyze extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

Contact us:

Introspective Market Research

3001 S King Drive,

Chicago, Illinois

60616 USA

Ph no: +1-773-382-1049

Email: sales@introspectivemarketresearch.com